Cruise and exploration company Lindblad Expeditions (NASDAQ:LIND) reported Q4 CY2024 results exceeding the market’s revenue expectations , with sales up 18.5% year on year to $148.6 million. The company’s full-year revenue guidance of $725 million at the midpoint came in 5.8% above analysts’ estimates. Its GAAP loss of $0.48 per share was 77.8% below analysts’ consensus estimates.

Is now the time to buy Lindblad Expeditions? Find out in our full research report .

Lindblad Expeditions (LIND) Q4 CY2024 Highlights:

Natalya Leahy, Chief Executive Officer, commented, "Experiencing our ships firsthand, I was both humbled and inspired by the truly unmatched adventures we offer, from the most agile and immersive expeditions to the warmth and intimacy of the atmosphere onboard. Lindblad Expeditions pioneered and perfected exploration in the world's most awe-inspiring destinations. 2024 was not only a record year, it was also a foundational one for future growth. With a strengthened Disney/National Geographic relationship, expanded capacity in core markets, and the increased scale of our six-brand portfolio, we are entering 2025 with strong tailwinds. This year, we are focused on driving demand, innovating smartly on costs, and unlocking new portfolio opportunities to further expand our reach and impact."

Company Overview

Founded by explorer Sven-Olof Lindblad in 1979, Lindblad Expeditions (NASDAQ:LIND) offers cruising experiences to remote destinations in partnership with National Geographic.

Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

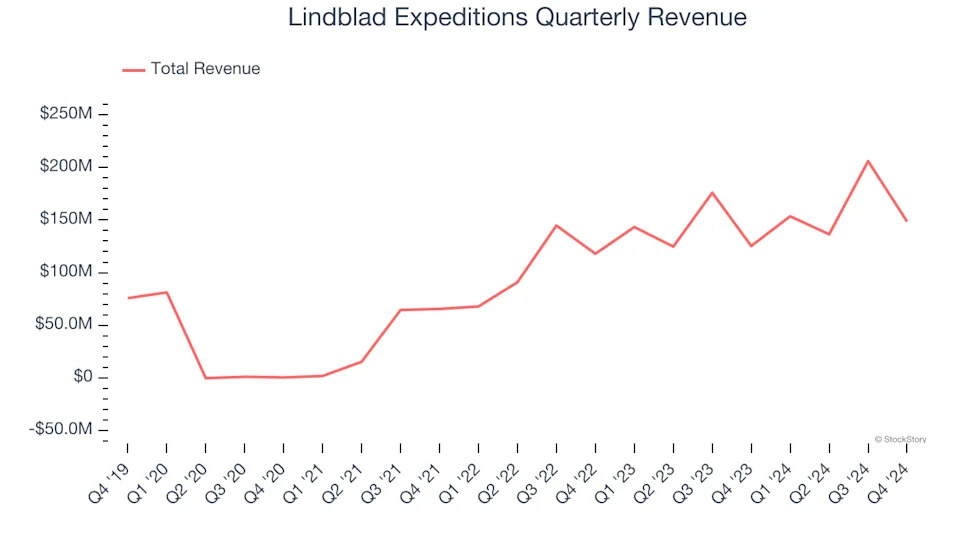

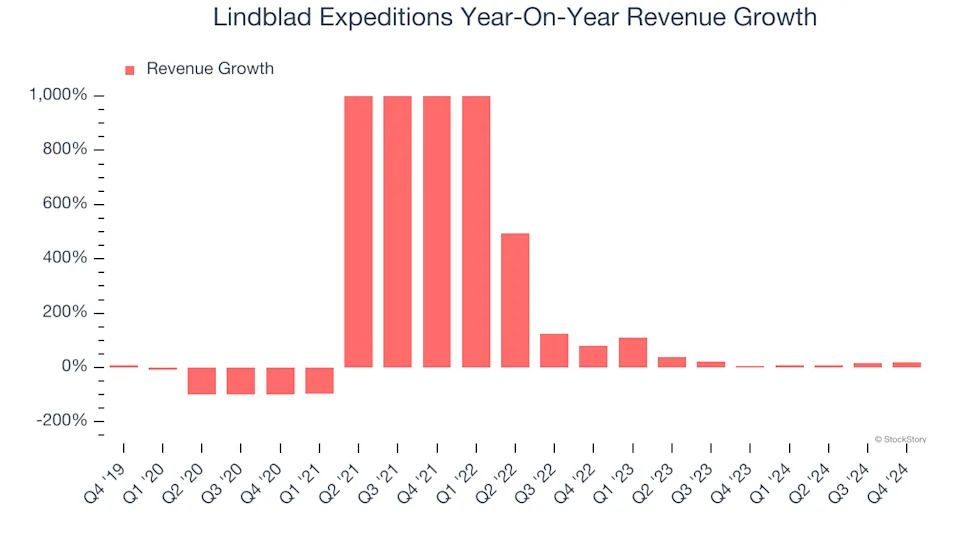

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Lindblad Expeditions grew its sales at a 13.4% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Lindblad Expeditions’s annualized revenue growth of 23.7% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Note that COVID hurt Lindblad Expeditions’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

This quarter, Lindblad Expeditions reported year-on-year revenue growth of 18.5%, and its $148.6 million of revenue exceeded Wall Street’s estimates by 10.2%.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Lindblad Expeditions has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.5%, lousy for a consumer discretionary business.

Lindblad Expeditions burned through $8.19 million of cash in Q4, equivalent to a negative 5.5% margin. The company’s cash burn was similar to its $17.11 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Over the next year, analysts predict Lindblad Expeditions’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 9.1% for the last 12 months will decrease to 5.4%.

Key Takeaways from Lindblad Expeditions’s Q4 Results

We liked that Lindblad Expeditions beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. On the other hand, its EPS missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better, and the stock traded down 1.3% to $10.98 immediately following the results.

So do we think Lindblad Expeditions is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .