Home warranty company Frontdoor (NASDAQ:FTDR) announced better-than-expected revenue in Q4 CY2024, with sales up 4.6% year on year to $383 million. On top of that, next quarter’s revenue guidance ($415 million at the midpoint) was surprisingly good and 3.1% above what analysts were expecting. Its non-GAAP profit of $0.27 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Frontdoor? Find out in our full research report .

Frontdoor (FTDR) Q4 CY2024 Highlights:

“2024 was truly an exceptional year for Frontdoor as we delivered record financial results, our operations performed better than ever and we completed the acquisition of 2-10,” said Chairman and Chief Executive Officer Bill Cobb.

Company Overview

Established in 2018 as a spin-off from ServiceMaster Global Holdings, Frontdoor (NASDAQ:FTDR) is a provider of home warranty and service plans.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Sales Growth

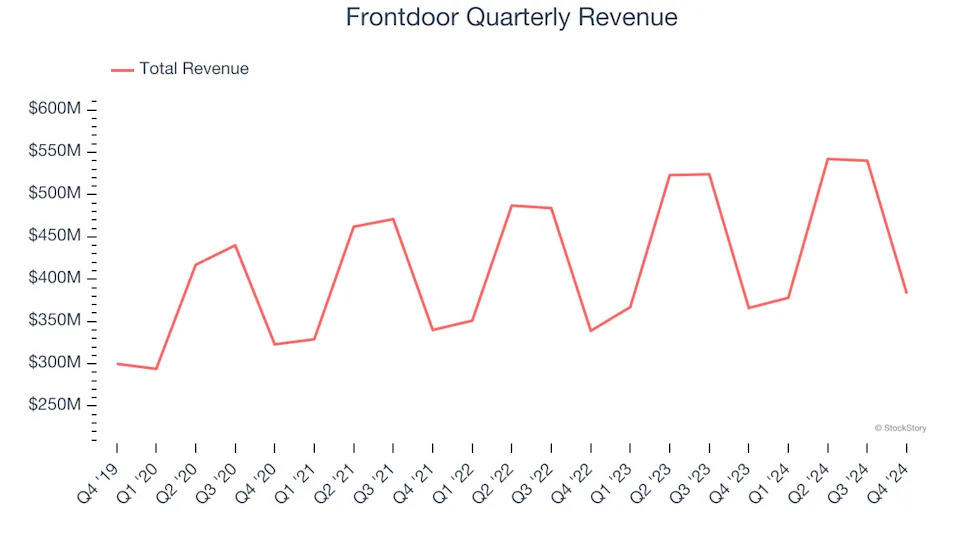

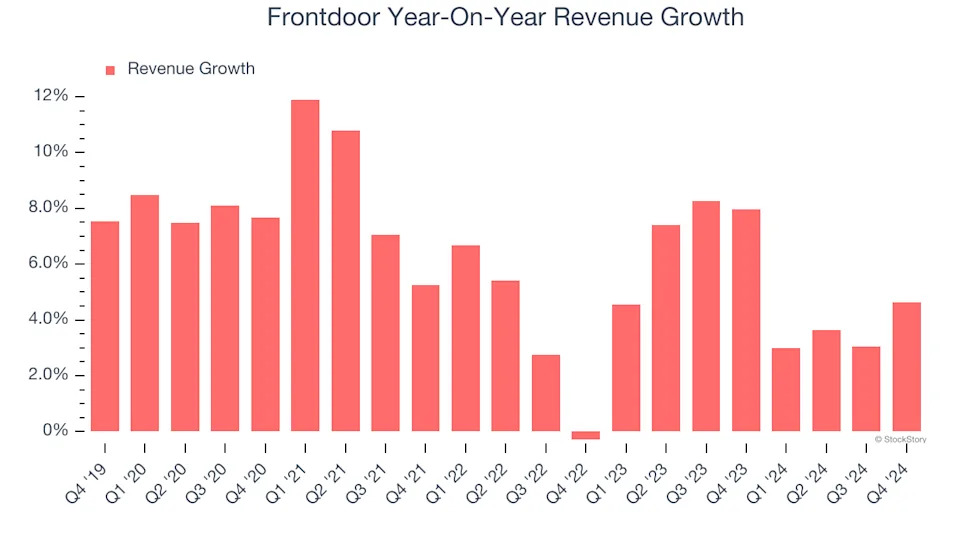

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Frontdoor’s 6.2% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Frontdoor’s annualized revenue growth of 5.3% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

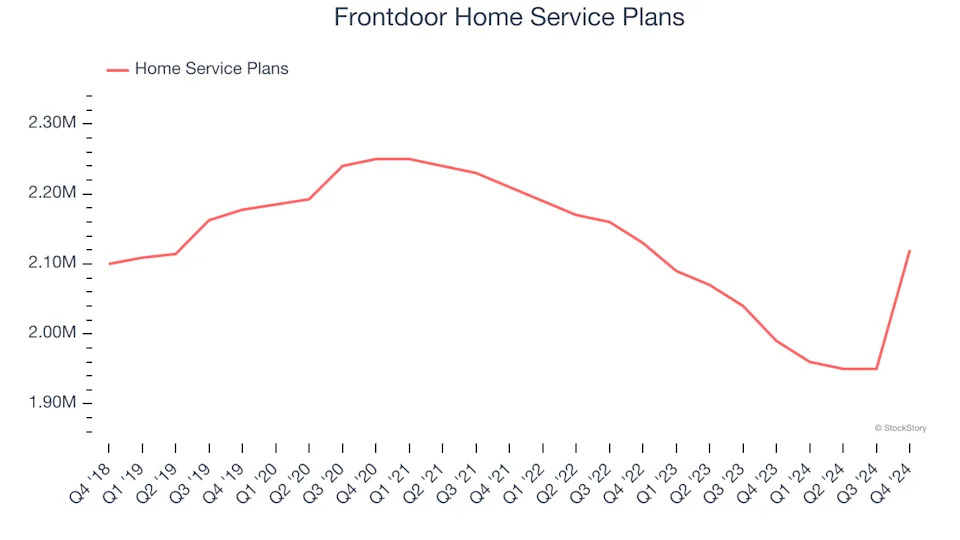

We can better understand the company’s revenue dynamics by analyzing its number of home service plans, which reached 2.12 million in the latest quarter. Over the last two years, Frontdoor’s home service plans averaged 3.9% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Frontdoor reported modest year-on-year revenue growth of 4.6% but beat Wall Street’s estimates by 4.1%. Company management is currently guiding for a 9.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

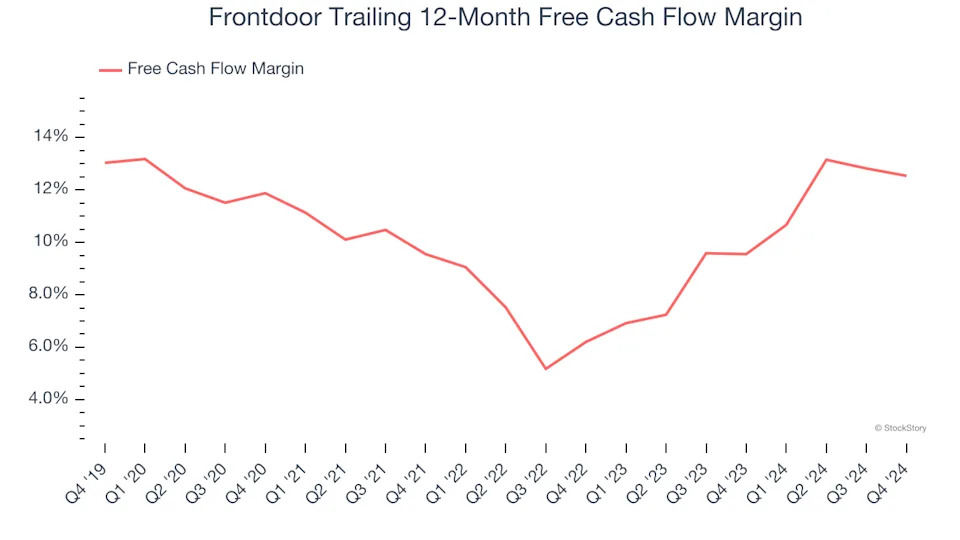

Frontdoor has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.1% over the last two years, slightly better than the broader consumer discretionary sector.

Frontdoor’s free cash flow clocked in at $51 million in Q4, equivalent to a 13.3% margin. The company’s cash profitability regressed as it was 1.4 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

Over the next year, analysts predict Frontdoor’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 12.5% for the last 12 months will decrease to 11.5%.

Key Takeaways from Frontdoor’s Q4 Results

We liked that Frontdoor beat analysts’ revenue, EBITDA, and EPS expectations this quarter. Guidance was also good, with full-year revenue and EBITDA guidance ahead. The stock remained flat immediately following the results.

So should you invest in Frontdoor right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .