Data warehouse-as-a-service Snowflake (NYSE:SNOW) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 27.4% year on year to $986.8 million. Its non-GAAP profit of $0.30 per share was 67.3% above analysts’ consensus estimates.

Is now the time to buy Snowflake? Find out in our full research report .

Snowflake (SNOW) Q4 CY2024 Highlights:

“We delivered another strong quarter, with product revenue of $943 million, up a strong 28% year-over-year, and remaining performance obligations totaling $6.9 billion,” said Sridhar Ramaswamy, CEO of Snowflake.

Company Overview

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE:SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

Data Storage

Data is the lifeblood of the internet and software in general, and the amount of data created is accelerating. As a result, the importance of storing the data in scalable and efficient formats continues to rise, especially as its diversity and associated use cases expand from analyzing simple, structured datasets to high-scale processing of unstructured data such as images, audio, and video.

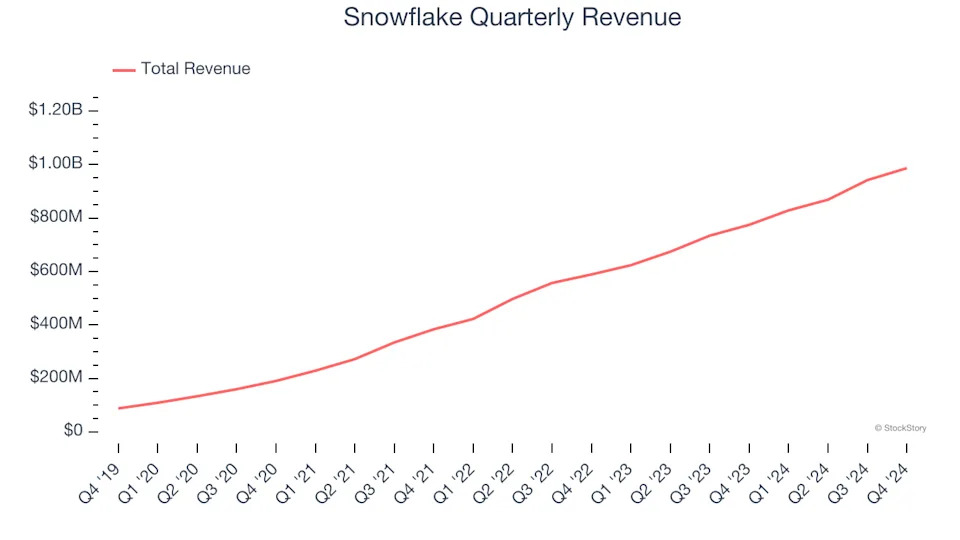

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Snowflake grew its sales at an incredible 43.8% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Snowflake reported robust year-on-year revenue growth of 27.4%, and its $986.8 million of revenue topped Wall Street estimates by 3%.

Looking ahead, sell-side analysts expect revenue to grow 22.3% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is admirable and suggests the market is forecasting success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

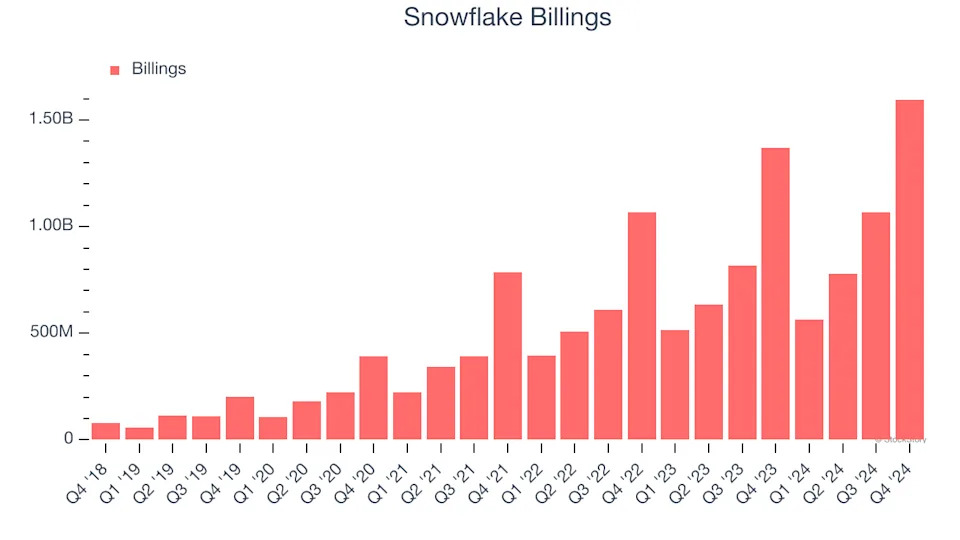

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Snowflake’s billings punched in at $1.60 billion in Q4, and over the last four quarters, its growth was impressive as it averaged 20.1% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

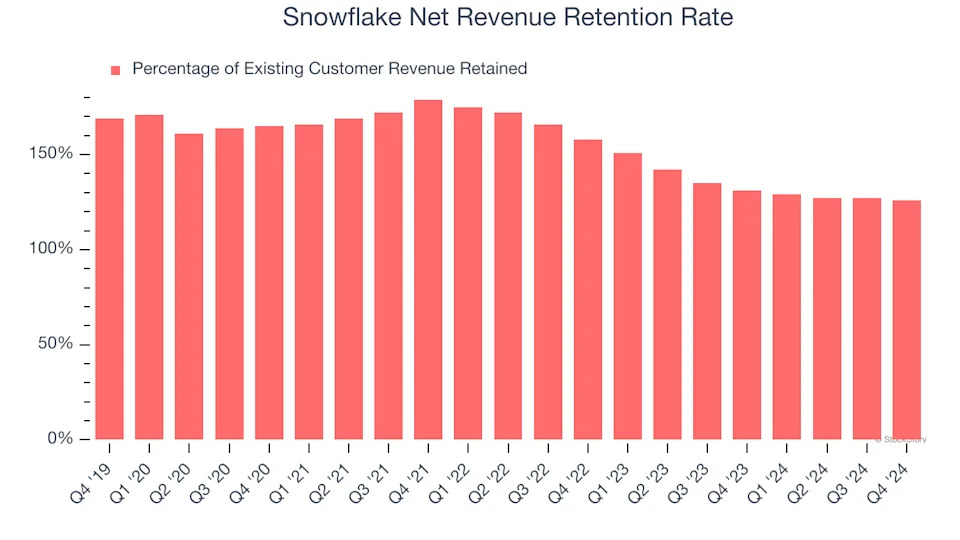

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Snowflake’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 127% in Q4. This means Snowflake would’ve grown its revenue by 27.2% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, Snowflake still has an excellent net retention rate. This data point proves that the company sells useful products, and we can see that its customers are satisfied and increasing usage over time.

Key Takeaways from Snowflake’s Q4 Results

It was encouraging to see Snowflake beat analysts’ revenue expectations this quarter. Operating profit beat by a convincing amount, showing strong operating leverage. Looking ahead, full-year product revenue guidance exceeded Wall Street's expectations. Overall, there was a lot to like about the quarter. The stock traded up 9% to $181.10 immediately after reporting.

So do we think Snowflake is an attractive buy at the current price? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .