Agricultural and farm machinery company Titan (NSYE:TWI) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 1.7% year on year to $383.6 million. On the other hand, next quarter’s outlook exceeded expectations with revenue guided to $475 million at the midpoint, or 1.9% above analysts’ estimates. Its GAAP profit of $2 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Titan International? Find out in our full research report .

Titan International (TWI) Q4 CY2024 Highlights:

Paul Reitz, President and Chief Executive Officer stated, "As we turn the page to 2025, we see a number of reasons to be optimistic that we will see a return to growth for Titan with an improving outlook supported by a combination of internal and external drivers. Internally, we have continued to invest in product innovation while also bolstering our one-stop shop offerings, all of which are enabling us to offer customers the best selection of products. A key part of that is our expanded aftermarket business, which has been a notable positive as it has helped to reduce the level of cyclicality across our three reporting segments. We have the broadest and best product offerings in the market, enabling us to build strong relationships with our customers, OEMs and the aftermarket alike. That will be very important as market conditions turn for the better, and we are well positioned."

Company Overview

Acquiring Goodyear’s farm tire business in 2005, Titan (NSYE:TWI) is a manufacturer and supplier of wheels, tires, and undercarriages used in off-highway vehicles such as construction vehicles.

Agricultural Machinery

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

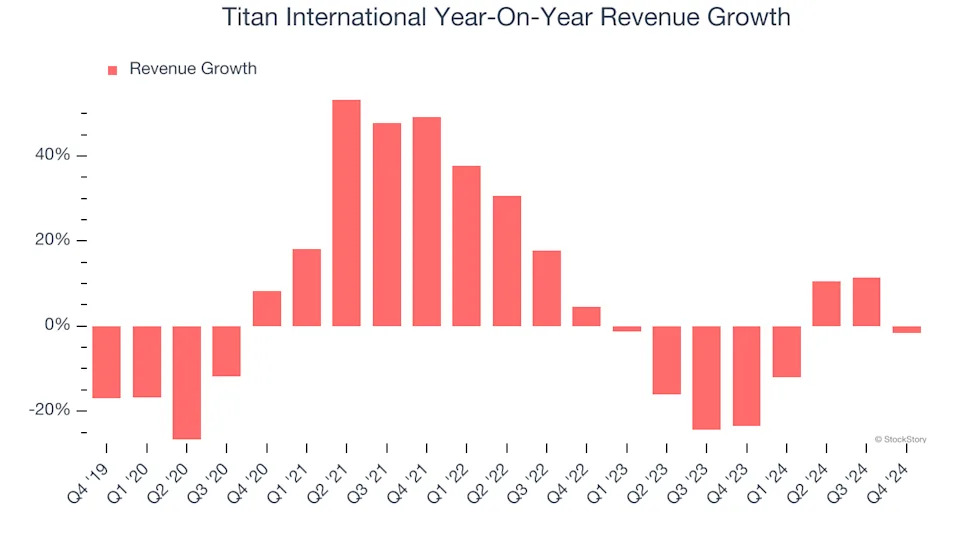

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Titan International’s 5% annualized revenue growth over the last five years was tepid. This was below our standard for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Titan International’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 7.8% annually.

This quarter, Titan International missed Wall Street’s estimates and reported a rather uninspiring 1.7% year-on-year revenue decline, generating $383.6 million of revenue. Company management is currently guiding for a 1.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.6% over the next 12 months. Although this projection is better than its two-year trend, it's tough to feel optimistic about a company facing demand difficulties.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Operating Margin

Titan International was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.3% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Titan International’s operating margin rose by 3 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Titan International generated an operating profit margin of negative 4.4%, down 9.7 percentage points year on year. Since Titan International’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

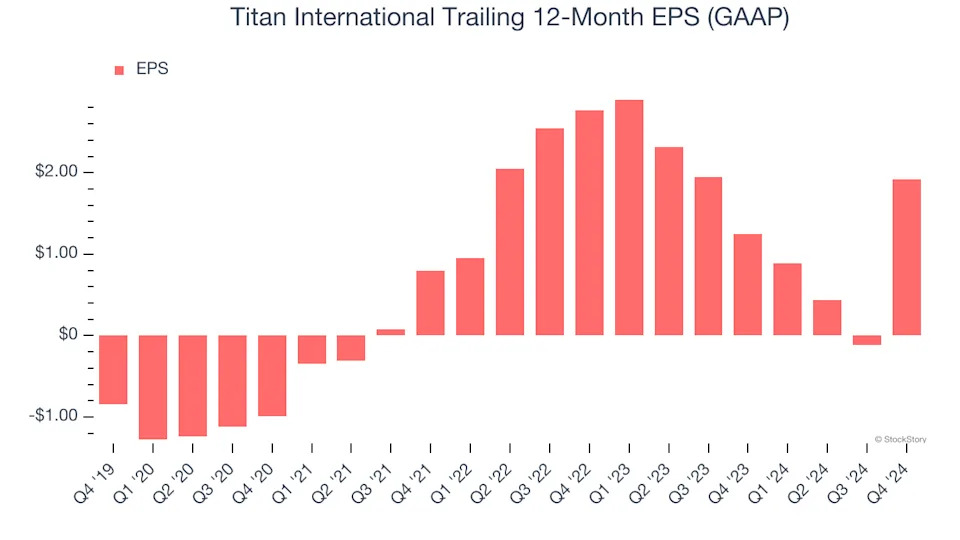

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Titan International’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Titan International, its EPS declined by more than its revenue over the last two years, dropping 16.7%. This tells us the company struggled to adjust to shrinking demand.

Diving into the nuances of Titan International’s earnings can give us a better understanding of its performance. Titan International’s operating margin has declined by 12.3 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Titan International reported EPS at $2, up from negative $0.04 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Titan International to perform poorly. Analysts forecast its full-year EPS of $1.92 will hit $0.15.

Key Takeaways from Titan International’s Q4 Results

We were impressed by Titan International’s optimistic revenue and EBITDA guidance for next quarter, which both beat analysts’ expectations. We were also excited its EPS outperformed Wall Street’s estimates by a wide margin this quarter. On the other hand, its revenue missed. Overall, we still think this was a decent quarter with some key metrics above expectations. The stock traded up 6.8% to $9.31 immediately after reporting.

Sure, Titan International had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .