Holding company and industrial conglomerate Icahn (NYSE:IEP) reported Q4 CY2024 results beating Wall Street’s revenue expectations , but sales fell by 11.1% year on year to $2.37 billion. Its GAAP loss of $0.19 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Icahn Enterprises? Find out in our full research report .

Icahn Enterprises (IEP) Q4 CY2024 Highlights:

Company Overview

Founded in 1987, Icahn Enterprises (NASDAQ: IEP) is a diversified holding company primarily engaged in investment and asset management across various sectors.

General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

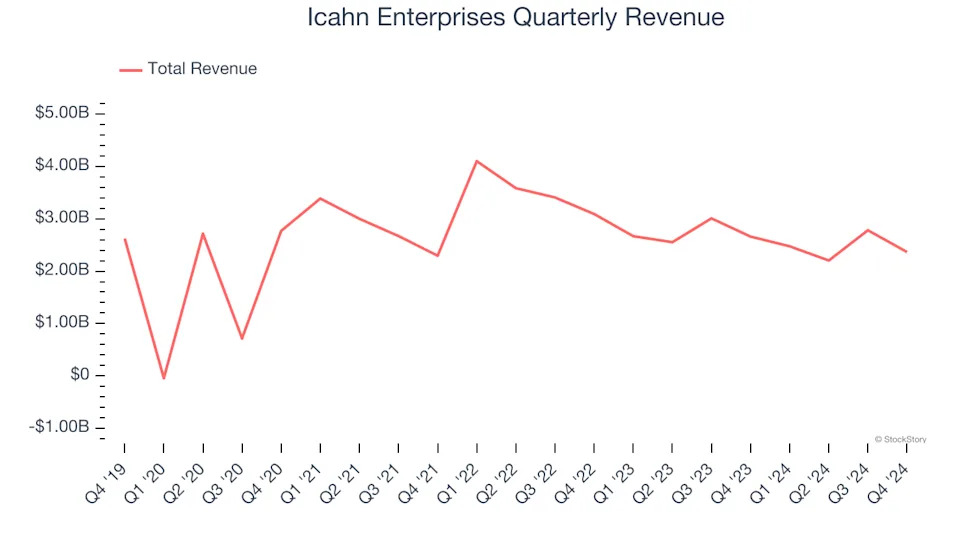

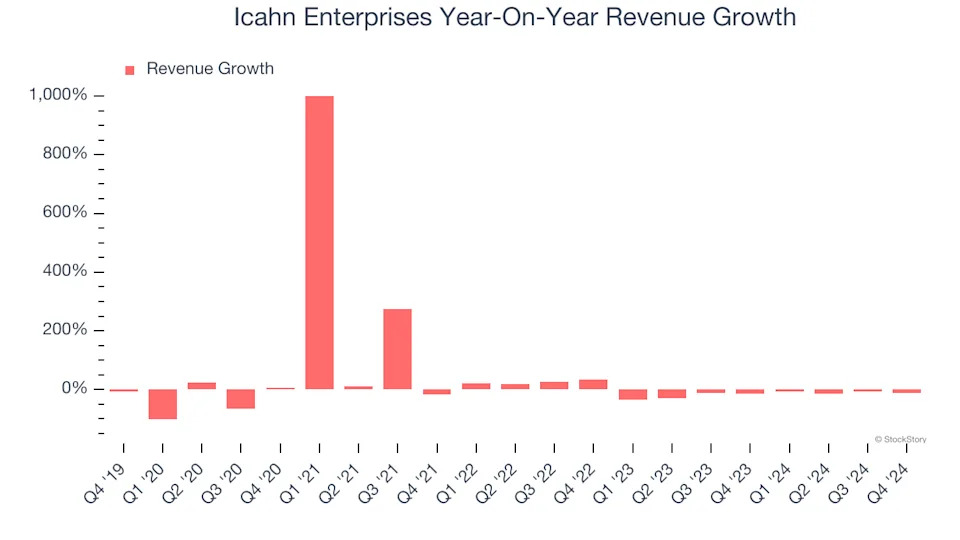

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Icahn Enterprises’s sales grew at a sluggish 2.4% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Icahn Enterprises’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 16.8% annually.

This quarter, Icahn Enterprises’s revenue fell by 11.1% year on year to $2.37 billion but beat Wall Street’s estimates by 4.2%.

Looking ahead, sell-side analysts expect revenue to decline by 11.5% over the next 12 months. While this projection is better than its two-year trend, it's tough to feel optimistic about a company facing demand difficulties.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

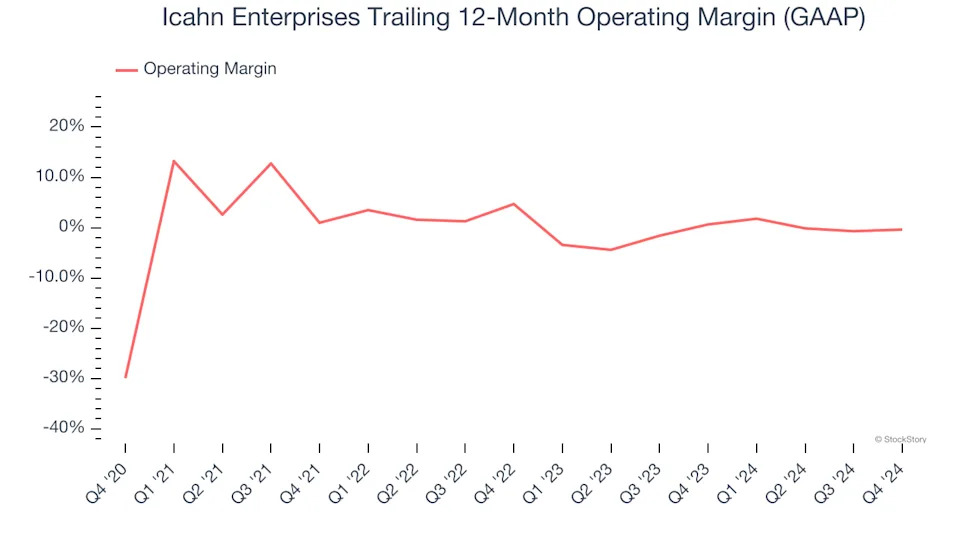

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Icahn Enterprises’s high expenses have contributed to an average operating margin of negative 2% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Icahn Enterprises’s operating margin rose by 29.5 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, Icahn Enterprises generated a negative 1.9% operating margin. The company's consistent lack of profits raise a flag.

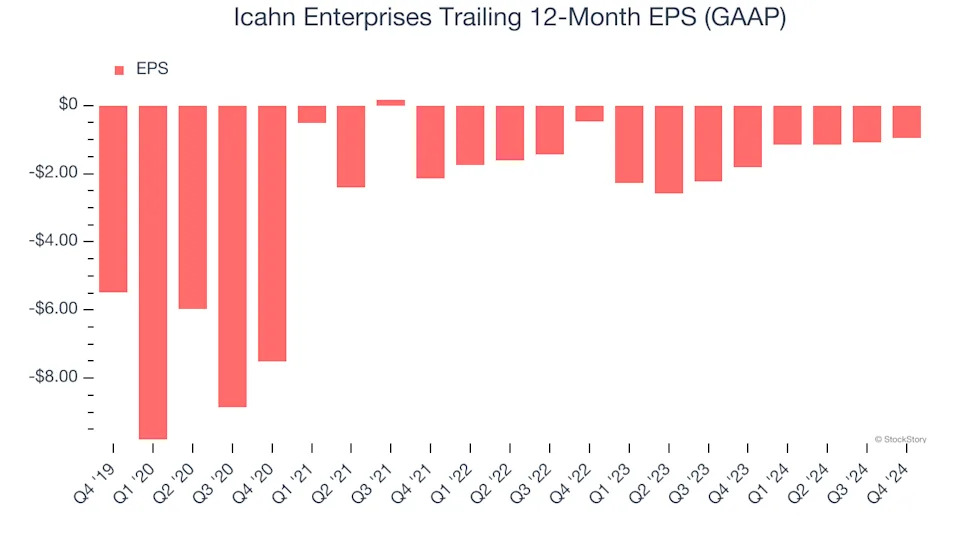

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Icahn Enterprises’s full-year earnings are still negative, it reduced its losses and improved its EPS by 29.6% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Icahn Enterprises, its two-year annual EPS declines of 43.7% mark a reversal from its (seemingly) healthy five-year trend. We hope Icahn Enterprises can return to earnings growth in the future.

In Q4, Icahn Enterprises reported EPS at negative $0.19, up from negative $0.33 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Icahn Enterprises’s full-year EPS of negative $0.95 will flip to positive $0.79.

Key Takeaways from Icahn Enterprises’s Q4 Results

We were impressed by how significantly Icahn Enterprises blew past analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this quarter was mixed. The stock traded up 1.2% to $10.40 immediately after reporting.

Big picture, is Icahn Enterprises a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .