Medical products company UFP Technologies (NASDAQ:UFPT) reported Q4 CY2024 results beating Wall Street’s revenue expectations , with sales up 41.9% year on year to $144.1 million. Its GAAP profit of $2.10 per share was 5.9% above analysts’ consensus estimates.

Is now the time to buy UFP Technologies? Find out in our full research report .

UFP Technologies (UFPT) Q4 CY2024 Highlights:

“I am very pleased with our fourth quarter and full-year 2024 results,” said R. Jeffrey Bailly, Chairman & CEO.

Company Overview

Founded in 1963, UFP Technologies (NASDAQ:UFPT) designs and manufactures medical products, sterile packaging, and other highly-engineered custom products for healthcare settings.

Drug Development Inputs & Services

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

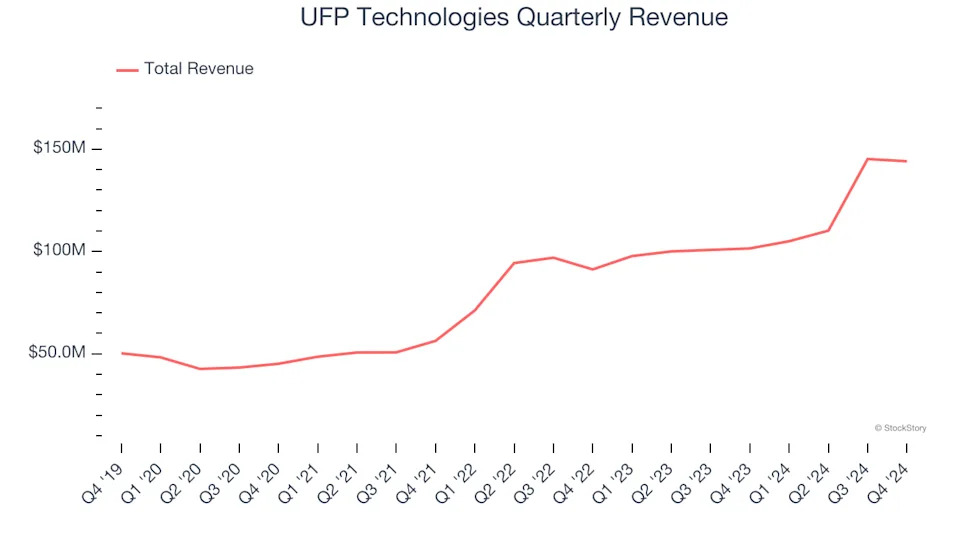

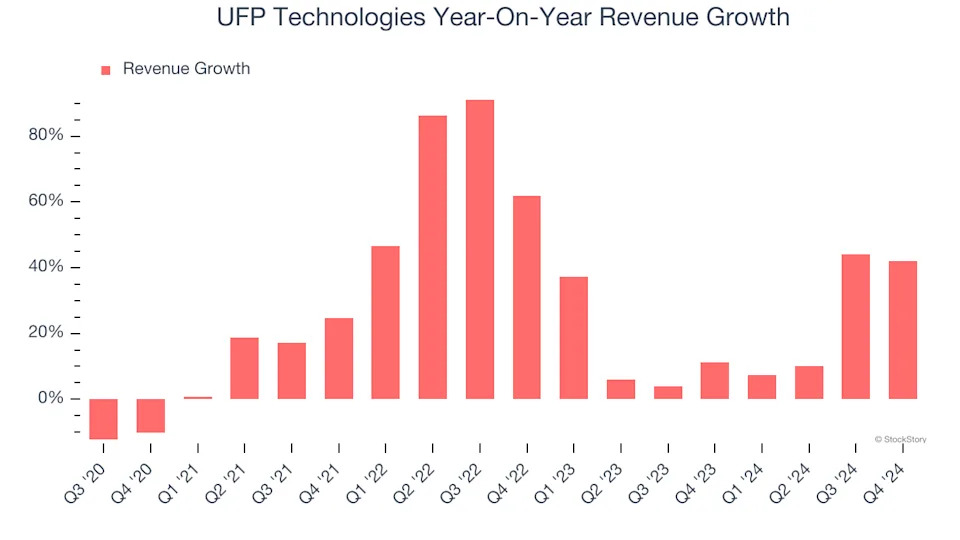

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, UFP Technologies’s sales grew at an excellent 23.8% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. UFP Technologies’s annualized revenue growth of 19.4% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, UFP Technologies reported magnificent year-on-year revenue growth of 41.9%, and its $144.1 million of revenue beat Wall Street’s estimates by 1.7%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

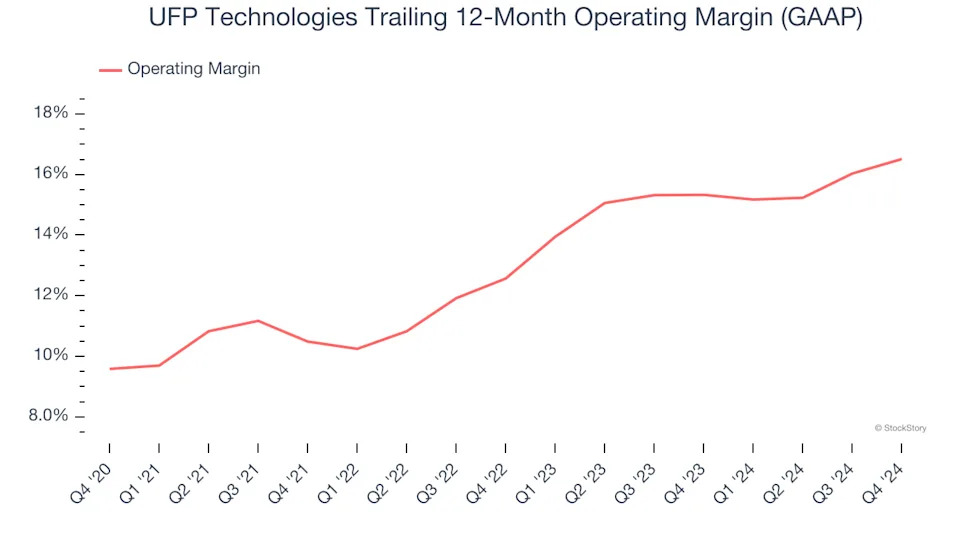

Operating Margin

UFP Technologies has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 13.9%, higher than the broader healthcare sector.

Looking at the trend in its profitability, UFP Technologies’s operating margin rose by 6.9 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 3.9 percentage points on a two-year basis.

This quarter, UFP Technologies generated an operating profit margin of 15.4%, up 2.6 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

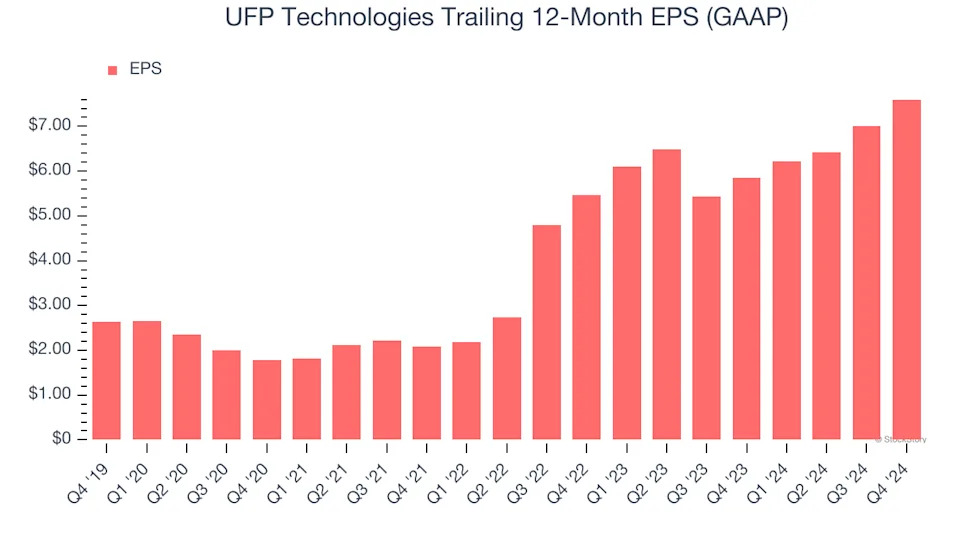

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

UFP Technologies’s astounding 23.5% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

In Q4, UFP Technologies reported EPS at $2.10, up from $1.51 in the same quarter last year. This print beat analysts’ estimates by 5.9%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from UFP Technologies’s Q4 Results

It was encouraging to see UFP Technologies beat analysts’ revenue, EPS, and EBITDA expectations this quarter. Overall, this quarter had some key positives. The stock traded up 2.7% to $247 immediately after reporting.

Sure, UFP Technologies had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .