Infrastructure construction company Primoris (NYSE:PRIM) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 14.9% year on year to $1.74 billion. Its non-GAAP profit of $1.13 per share was 51.2% above analysts’ consensus estimates.

Is now the time to buy Primoris? Find out in our full research report .

Primoris (PRIM) Q4 CY2024 Highlights:

“Primoris delivered another year of profitable growth in 2024, highlighting the successful execution of our strategy to allocate capital toward the highest return businesses and prioritize cash flow generation. We finished the year with record levels of revenue, operating income, and cash flow from operations. These accomplishments enabled us to improve margins, pay down debt and set us on a solid path to accomplish the multi-year financial and operational targets we set in the first half of 2024,” said Tom McCormick, President and Chief Executive Officer of Primoris.

Company Overview

Listed on the NASDAQ in 2008, Primoris (NYSE:PRIM) builds, maintains, and upgrades infrastructure in the utility, energy, and civil construction industries.

Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Sales Growth

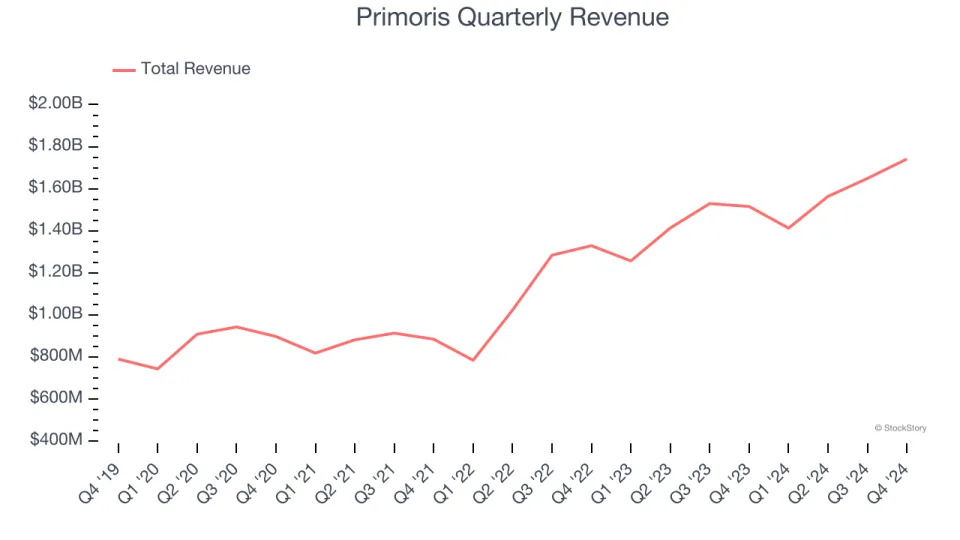

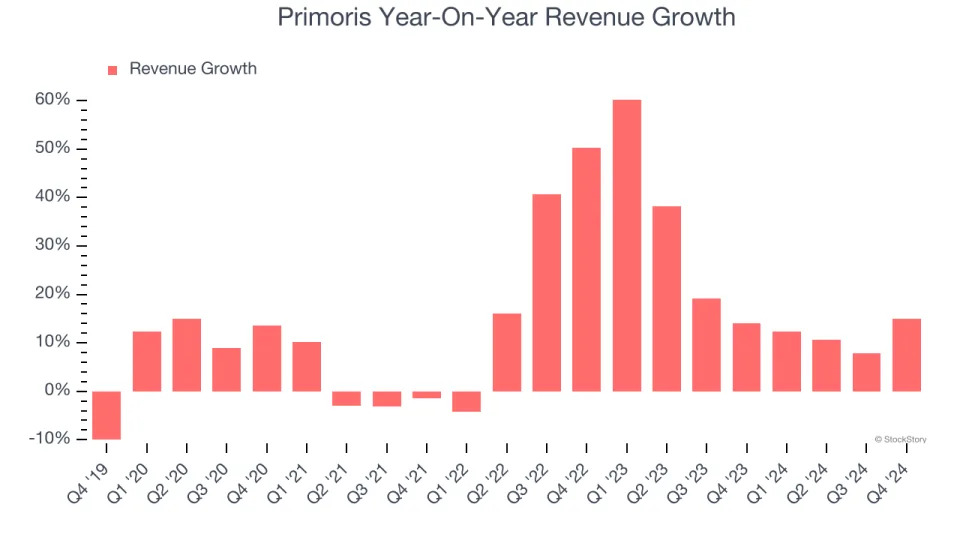

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Primoris’s sales grew at an incredible 15.4% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Primoris’s annualized revenue growth of 20% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

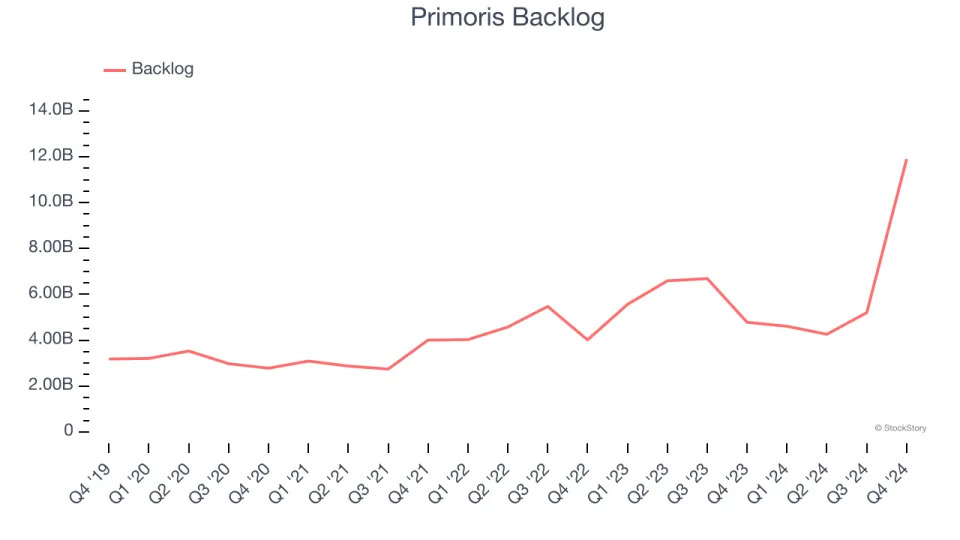

Primoris also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Primoris’s backlog reached $11.9 billion in the latest quarter and averaged 24.7% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Primoris’s products and services but raises concerns about capacity constraints.

This quarter, Primoris reported year-on-year revenue growth of 14.9%, and its $1.74 billion of revenue exceeded Wall Street’s estimates by 8.8%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

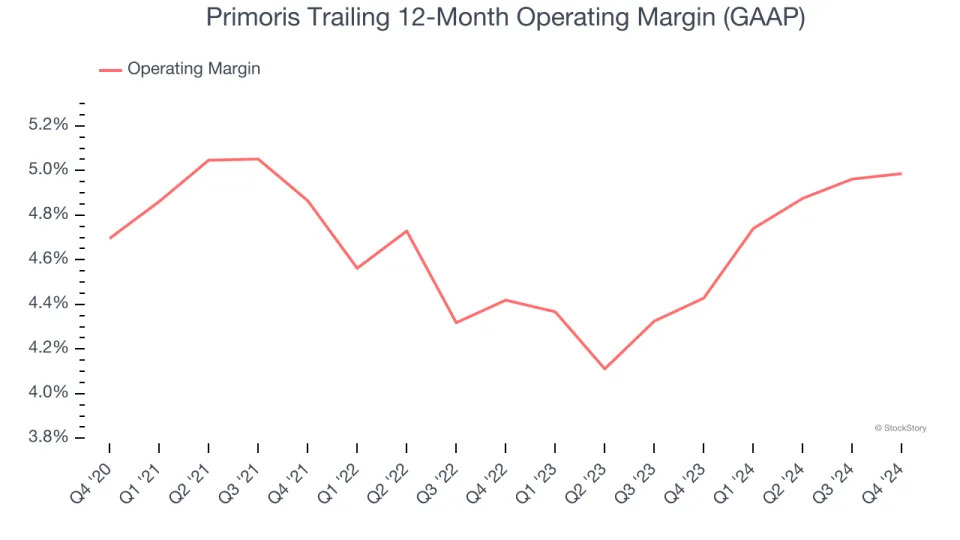

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Primoris was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.7% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Primoris’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises an eyebrow about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Primoris generated an operating profit margin of 5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

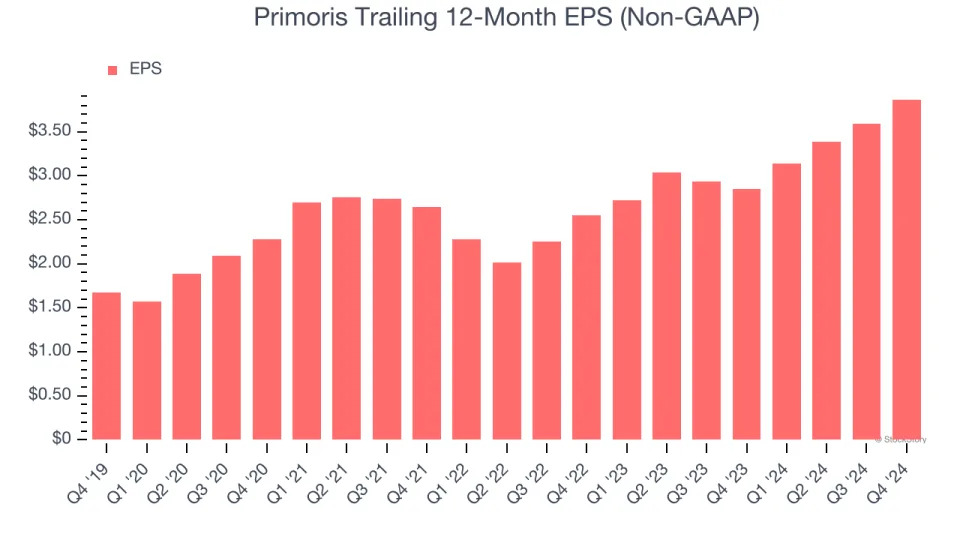

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Primoris’s EPS grew at an astounding 18.3% compounded annual growth rate over the last five years, higher than its 15.4% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t expand and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Primoris, its two-year annual EPS growth of 23.1% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Primoris reported EPS at $1.13, up from $0.85 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Primoris’s full-year EPS of $3.87 to grow 3%.

Key Takeaways from Primoris’s Q4 Results

We were impressed by how significantly Primoris blew past analysts’ backlog, revenue, EPS, and EBITDA expectations this quarter. We were also excited its full-year EPS and EBITDA guidance outperformed Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock traded up 8.1% to $69.50 immediately following the results.

Indeed, Primoris had a rock-solid quarterly earnings result, but is this stock a good investment here? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .