Financial services company Robinhood (NASDAQ:HOOD) announced better-than-expected revenue in Q4 CY2024, with sales up 115% year on year to $1.01 billion. Its GAAP profit of $1.01 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Robinhood? Find out in our full research report .

Robinhood (HOOD) Q4 CY2024 Highlights:

“We hit the gas on product development in 2024 with a new platform for active traders, Gold Card launch, an expanded UK and EU product suite, and much more,” said Vlad Tenev, CEO and Co-Founder of Robinhood.

Company Overview

With a mission to democratize finance, Robinhood (NASDAQ:HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

Financial Technology

Financial technology companies benefit from the increasing consumer demand for digital payments, banking, and finance. Tailwinds fueling this trend include e-commerce along with improvements in blockchain infrastructure and AI-driven credit underwriting, which make access to money faster and cheaper. Despite regulatory scrutiny and resistance from traditional financial institutions, fintechs are poised for long-term growth as they disrupt legacy systems by expanding financial services to underserved population segments.

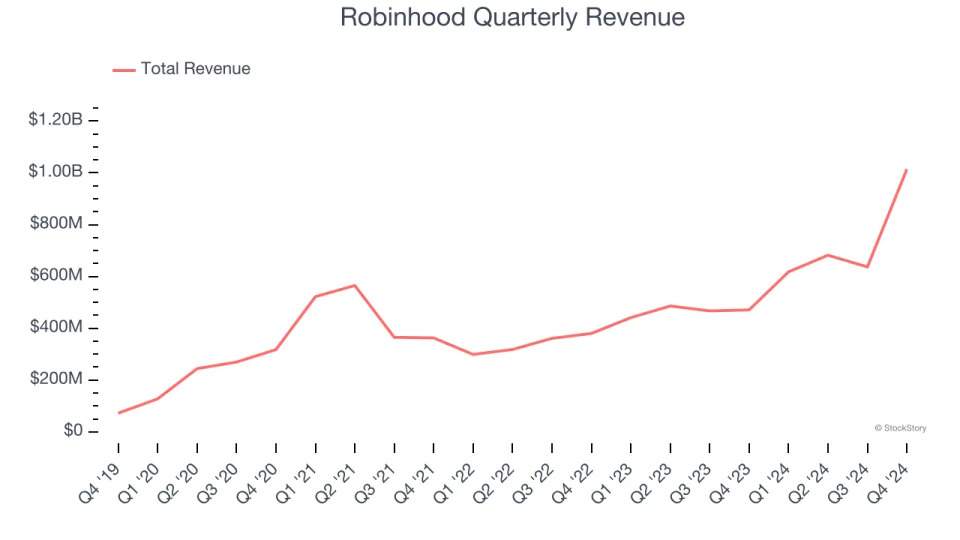

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Robinhood’s sales grew at a solid 17.6% compounded annual growth rate over the last three years. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Robinhood reported magnificent year-on-year revenue growth of 115%, and its $1.01 billion of revenue beat Wall Street’s estimates by 7.7%.

Looking ahead, sell-side analysts expect revenue to grow 15.8% over the next 12 months, a slight deceleration versus the last three years. Still, this projection is admirable and suggests the market is factoring in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Funded Customers

User Growth

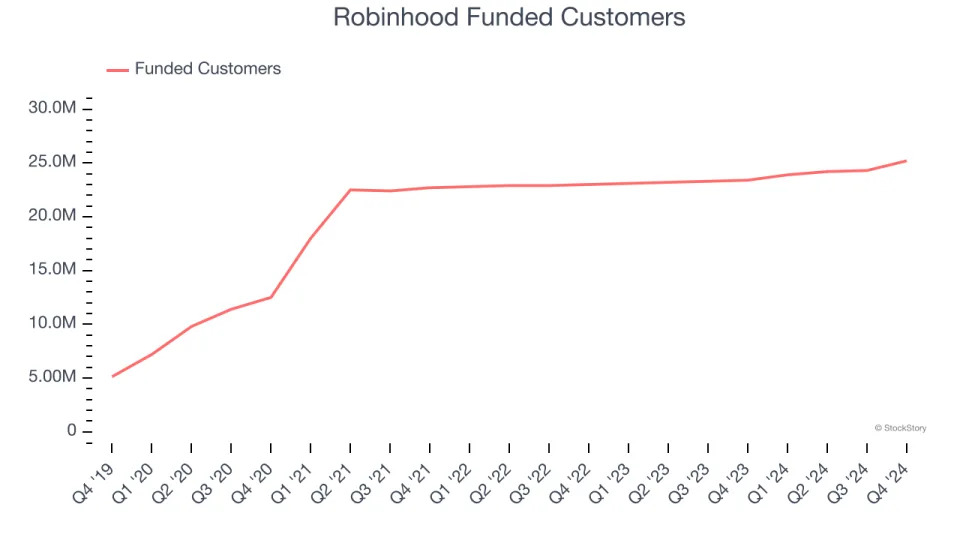

As a fintech company, Robinhood generates revenue growth by increasing both the number of users on its platform and the number of transactions they execute.

Over the last two years, Robinhood’s funded customers, a key performance metric for the company, increased by 3.2% annually to 25.2 million in the latest quarter. This growth rate lags behind the hottest consumer internet applications. If Robinhood wants to accelerate growth, it likely needs to engage users more effectively with its existing offerings or innovate with new products.

In Q4, Robinhood added 1.8 million funded customers, leading to 7.7% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

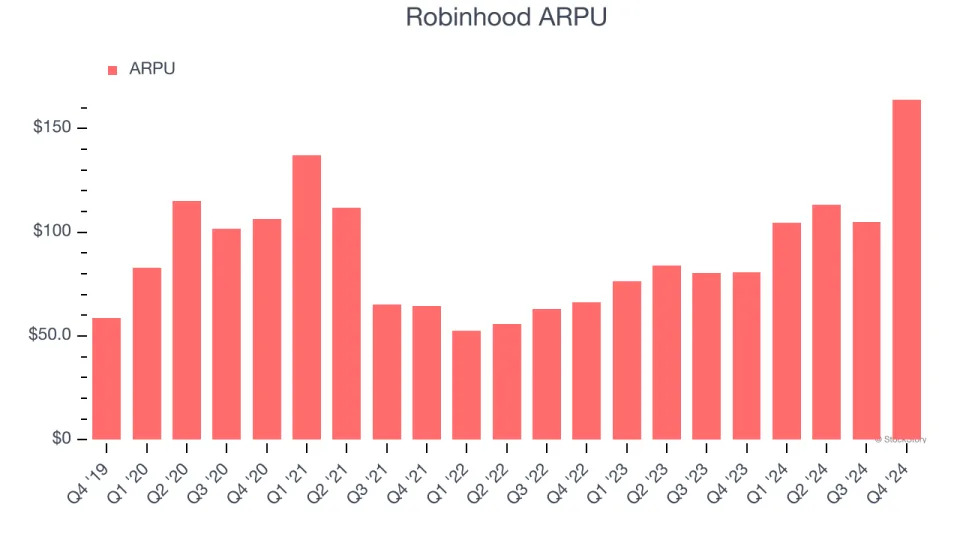

Average revenue per user (ARPU) is a critical metric to track for fintech businesses like Robinhood because it measures how much the company earns in fees from each user. ARPU also gives us unique insights into the average transaction size on its platform and Robinhood’s take rate, or "cut", on each transaction.

Robinhood’s ARPU growth has been exceptional over the last two years, averaging 43.9%. Its ability to increase monetization while growing its funded customers demonstrates its platform’s value, as its users are spending significantly more than last year.

This quarter, Robinhood’s ARPU clocked in at $164. It grew by 103% year on year, faster than its funded customers.

Key Takeaways from Robinhood’s Q4 Results

We were impressed by how significantly Robinhood blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. Specifically, cryptocurrency trading revenues soared by 700%+ year-on-year while equities and options increased by 144% and 83%, respectively - note that crypto and options trading are more profitable business lines than equities due to the wider spreads. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 5.4% to $58.97 immediately following the results.

Robinhood put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .