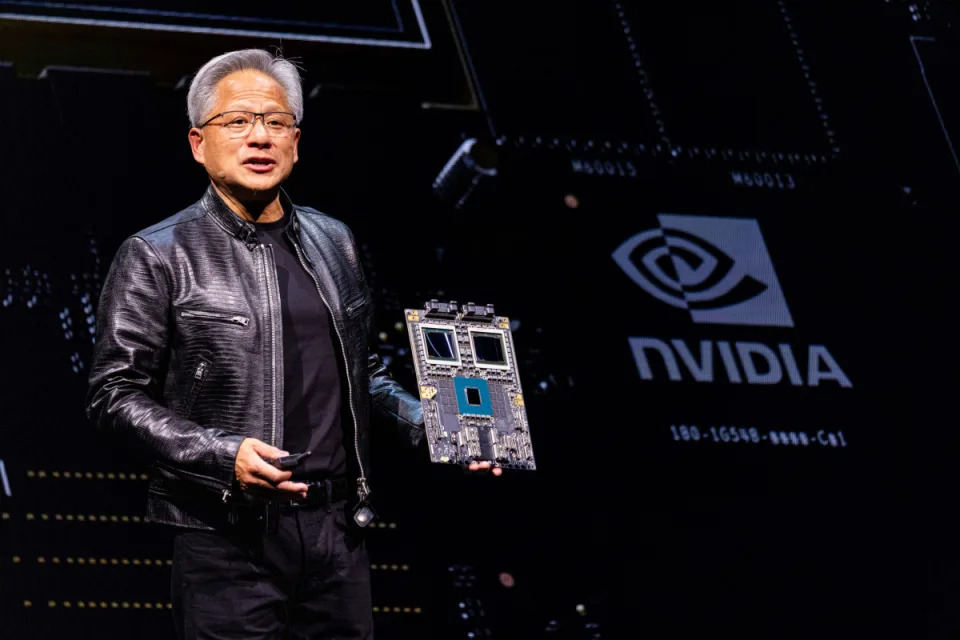

Nvidia shares bumped higher in late-morning Tuesday trading, and edged into positive territory for the year, following a bullish note on Blackwell chip demand heading into the AI market leader's fiscal-fourth-quarter earnings next month.

The Santa Clara, Calif., group's shares have largely underperformed the broader tech market over the past three months, falling around 3.4% and trailing the 6% advance for the Nasdaq. The market move comes amid concern about the impact of U.S. export restrictions on chip sales to China and reports of delayed orders for its new Blackwell processors tied to performance issues.

Related: Cathie Wood buys $8 million of surging tech stock

Blackwell, launched last year, is seen as a crucial revenue driver for the group over the coming years. That's as hyperscalers such as Microsoft, Meta Platforms and Google parent Alphabet ramp up data-center spending and roll out their AI-powered offerings to clients while infusing their in-house product lines.

Limited time! Get TheStreet Pro’s quarterly call for free. Expert analysts and fund managers share their 2025 strategies. Start your free trial today

The Information reported last week that the first shipments of so-called Blackwell racks — which stack the new chips in a way that increases computing power with less energy and more efficiency — have been prone to overheating and glitching.

That's raised some concern that Nvidia's transition from its Hopper sales, which predate Blackwell, could be delayed into the second half as the Blackwell technical issues are addressed.

Nvidia's Blackwell sales strengthening: analyst

New rules unveiled in the final weeks of the Biden administration, meanwhile, will limit exports of AI technologies to some countries, including Singapore, Israel, Saudi Arabia and the United Arab Emirates, while maintaining outright bans on sales to Russia, Iran, China and North Korea.

Nvidia which generates around 30% of its revenue from Taiwan and China, called the complicated new rules a "regulatory morass" and accused the Biden administration of "undermining America’s leadership" in AI technologies.

Related: Analyst revisits Nvidia stock price target amid correction slump

UBS analyst Timothy Arcuri, however, sees Blackwell sales improving notably in Nvidia's current quarter, which ends in January, and rising into the coming financial year and beyond.

"We believe Blackwell chipset/compute board yields have improved, with a rapid shift in mix from Hopper to Blackwell in fiscal Q4 (January) and fiscal Q1 (April)," Arcuri said in a note published Tuesday. He reiterated his $185 price target on the shares.

The analyst also cited record earnings from Foxconn, the world's biggest contract electronics maker and a key Nvidia supplier, as supporting the case for accelerated B200 and GB200 Blackwell shipments.

Foxconn results bullish for Nvidia

Earlier this month, Foxconn, formally Hon Hai Precision Industry, reported record fourth-quarter revenue of $64.7 billion. It said current quarter revenue would likely show "significant growth" from the year-ago period.

Related: Every major Wall Street analyst's S&P 500 forecast for 2025

"As a result, we now see Blackwell revenue at around $9 billion in the January quarter vs. around $5 billion previously, but we believe Hopper will be down," Arcuri said.

That leaves Nvidia likely to post overall fourth-quarter revenue of around $42 billion, Arcuri estimates, and $47 billion over the three months ending in April.

More AI Stocks:

Nvidia, which guides investors on revenue and profit forecasts for only the coming quarter, sees an end-January revenue tally of $37.5 billion, with analysts pegging its data-center total for fiscal 2025 at $113.36 billion.

For its Blackwell processors alone, Wall Street analysts expect several billion of revenue in Nvidia's fourth quarter, with totals of $62 billion in 2025 and $97 billion in 2026.

Nvidia shares were last marked 0.74% higher in midday trading, changing hands at $138.89 each.

Related: Veteran fund manager issues dire S&P 500 warning for 2025