Memecoins like the TRUMP token illustrate the FOMO-driven frenzy of the crypto world, where value often hinges on social media and cultural hype rather than tangible assets. Critics compare these tokens to speculative bubbles, as their reliance on new buyers to sustain prices can leave investors holding little more than 'virtual pixels' if the bubble bursts.

Yet, the decentralized finance (DeFi) space isn't just about emotionally driven investing. Real world asset (RWA) tokens, backed by tangibles like real estate or art, introduce utility, contrasting with memecoins. These tokens mimic traditional finance (TradFi) investments but with blockchain advantages like fractional ownership.

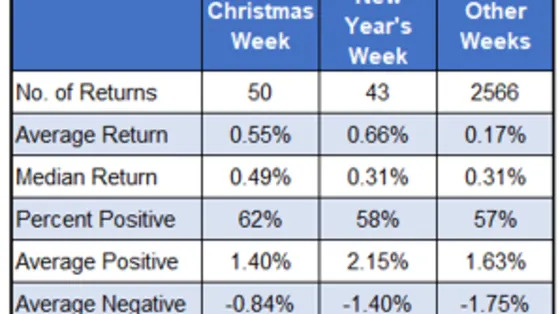

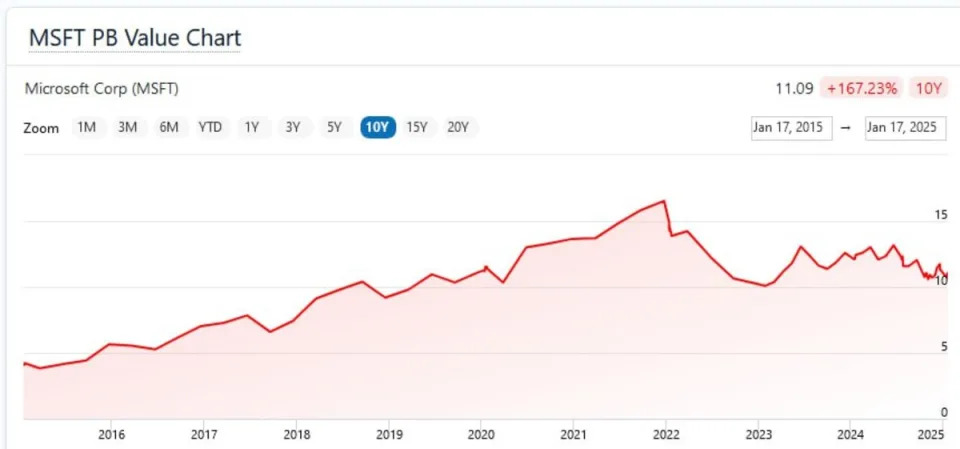

The crypto market dichotomy mirrors traditional markets, where companies like GameStop saw stock prices soar during the 2021 short squeeze, driven by social media rather than intrinsic value. Meanwhile, tech giants like Microsoft trade at high price-to-book (P/B) ratios, reflecting confidence in future growth and intangible assets, highlighting how market valuations often exceed traditional metrics.

Comparison reveals the hypocrisy in labeling memecoins as uniquely speculative. Both TradFi and DeFi are influenced by hype and sentiment. While the TRUMP token may exemplify risk, RWA tokens demonstrate blockchain's potential to blend speculation with true utility.

Tokenized assets offer investors an opportunity to diversify with minimal correlation to traditional financial assets. Studies reveal that less than 2.2% of future uncertainty in cryptocurrency prices is influenced by non-crypto assets, positioning RWAs as a potential counter-cyclical hedge. Moreover, correlations between cryptocurrencies and traditional assets like stocks, bonds, and gold remain negligible. By incorporating RWAs, investors can mitigate crypto market volatility, promote a more balanced and resilient investment strategy, and then potentially open up room for riskier positions, such as memecoins, within their portfolios.

Each Individual has the right to choose their own risk tolerance, be it diving into the 'Wild West' of memecoins or treading the steadier path of asset-backed investments. The evolving financial landscape calls for a nuanced grasp of risk versus reward. As investors navigate a market where speculation and tangible value intertwine, they redefine the essence of worth in modern finance. With a clearly more crypto-friendly administration, the potential for innovation and growth in this space is immense. Ultimately, understanding your risk tolerance—and adhering to your financial compass—might just be the shrewdest move of all.

If you enjoyed this article, please show your support by leaving a comment, and following us on X (formerly Twitter) @RWA_Alpha . The best way to support us is by engaging our content and joining the conversation below. We’re modern-day alchemists, transforming complex market chatter into actionable insights.

Disclaimer: Please note, none of this article is to be construed as financial advice or an endorsement to purchase any digital assets. Do your own research and consult a professional financial advisor prior to making any investments.

Disclosure: The author(s) of this article may have a financial interest in the token of the company or blockchain covered in this publication. The views expressed in this article accurately reflect the personal views of the author(s) about the subject, securities, or issuers, and no part of the compensation of the author(s) was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this commentary. The author(s) may hold a long/short position in the token of the blockchain or company (if any) discussed in this article, and as content contributors, they are not subject to no-trade lists.