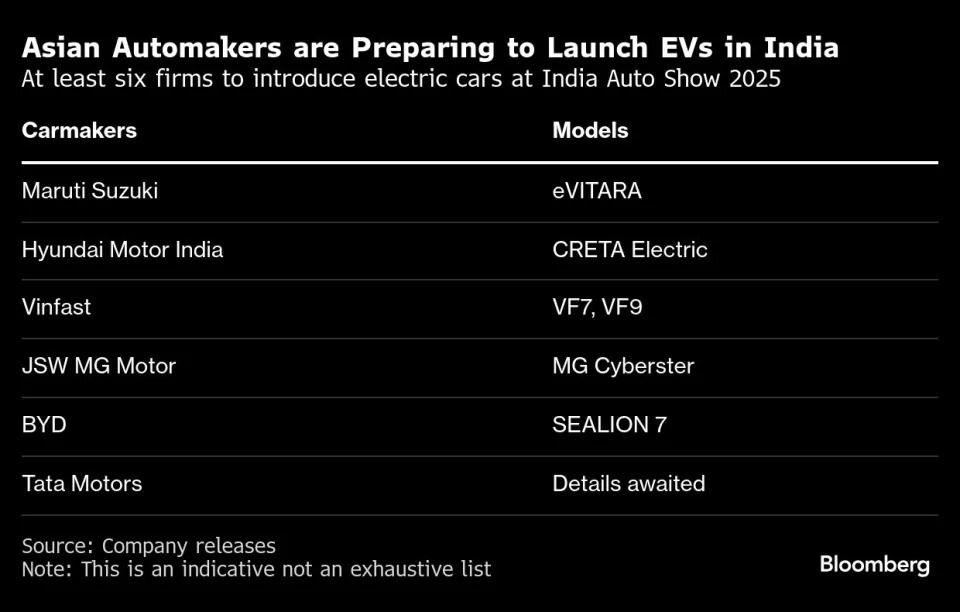

(Bloomberg) — Suzuki Motor Corp.’s India unit, BYD Co. and VinFast Auto Ltd. are among carmakers gearing to showcase their new electric vehicles in New Delhi as the fight intensifies for the fastest-growing major automobile market where Tesla Inc. is conspicuous by its absence.

The annual event this week, called Bharat Mobility Global Expo, will see country’s largest carmaker, Maruti Suzuki India Ltd., and VinFast debut their EVs, while China’s BYD and local heavyweights, Hyundai Motor India Ltd. and Tata Motors Ltd., will add to their existing offerings.

Tesla’s reluctance to enter India — it had registered a local unit more than four years ago — has given competitors a headstart in the country’s nascent but rapidly expanding EV market.

Maruti Suzuki — a late-entrant to India’s EV market that has so far been dominated by Tata Motors — will introduce e-Vitara at this show, an electric SUV jointly developed with Toyota Motor Corp. VinFast’s five-seater VF7 and bigger SUV VF9 are among other new models that will be previewed at the auto show.

Bright Spot

The new launches will serve to boost the penetration of EVs in India. The country is the world’s third-biggest greenhouse gas emitter but is seeking to decarbonize its economy and turn net zero by 2070.

That coupled with the country’s increasingly affluent shoppers makes India one of the few bright spots for EVs.

“When you have some of the global manufacturers coming in, it creates a lot of buzz,” said Amit Bhatt, India managing director at the International Council for Clean Transportation. It will also develop the EV ecosystem such as charging infrastructure, he said.

Road transport is estimated to account for as much as 30% of air pollution that shrouds India’s biggest urban centers, according to the International Energy Agency.

That could change with a rapid switch to EVs, which accounted for just 2.4% of the more than 4 million vehicles sold in India last year. And the upcoming car launches can expedite that.

‘Bit of FOMO’

If all the carmakers are going to converge in India and participate, Tesla should have “a little bit of FOMO in coming days,” Bhatt said.

Tesla and India have been at an impasse for years over high import taxes that its Chief Executive Officer Elon Musk has repeatedly pointed out as a deterrent.

Musk was scheduled to visit India in April last year and meet the Indian Prime Minister Narendra Modi, sparking speculation about the US carmaker’s investments in the South Asian nation that included setting up a manufacturing facility.

Musk, days later, postponed his visit to tend to pressing issues at Tesla that had slashed its workforce and recalled some of its vehicles in the US.

Tesla has for years been been making a case for cutting import taxes before it commits to any significant investment in India. New Delhi in March slashed the import duty on EVs for companies that set up local factories with at least 41.5 billion rupees ($500 million) of investment.

With Tesla yet to firm up its India plans, the competition for market share remains chiefly among Asian players and is set to heat up as sector leader Maruti Suzuki joins the fray.

Maruti Suzuki, the nation’s biggest carmaker by volume, has time and again demonstrated its ability to capture a big slice of the market even if it enters late — with its diesel offerings and compact SUVs in the past.

Maruti’s e-Vitara will be up against Hyundai’s Creta Electric, Toyota’s Urban Cruiser EV, MG’s Cyberster and Kia Carens EV. In the meantime, Tata Group’s automobile unit, which has over 60% of India’s green vehicles market, will look to fend off new entrants this year.